Who pays for news?

Independent journalism is one of the cornerstones of democracy – and it’s on shaky ground. Since the dawn of the internet, major media houses, the traditional gatekeepers of ‘truth’, have been under threat. Social media was the nail in the coffin for many iconic publications. As advertising revenue drained away and news became ‘content’, one publication after the next was shut down. In the US, so-called ‘vulture capitalists’ – unscrupulous private equity firms – bought up one Pulitzer prize-winning newspaper after the next to sell for scrap. Locally, Independent Media has been the casualty of similar behaviour.

The publications that remain are struggling to hold on. Some sites like News24 have introduced a paywall to limit access, whereas others like Daily Maverick appeal to their readers’ social conscience and rely on donations (and grant funding) to pay the salaries of their journalists. However, the vast majority of news sites are still stuck in the original internet model of free access with banner advertising and pop-ups.

During the 2024 general election, many of us relied on trusted news sources for updates and interpretation. This got us thinking: Who pays for news?

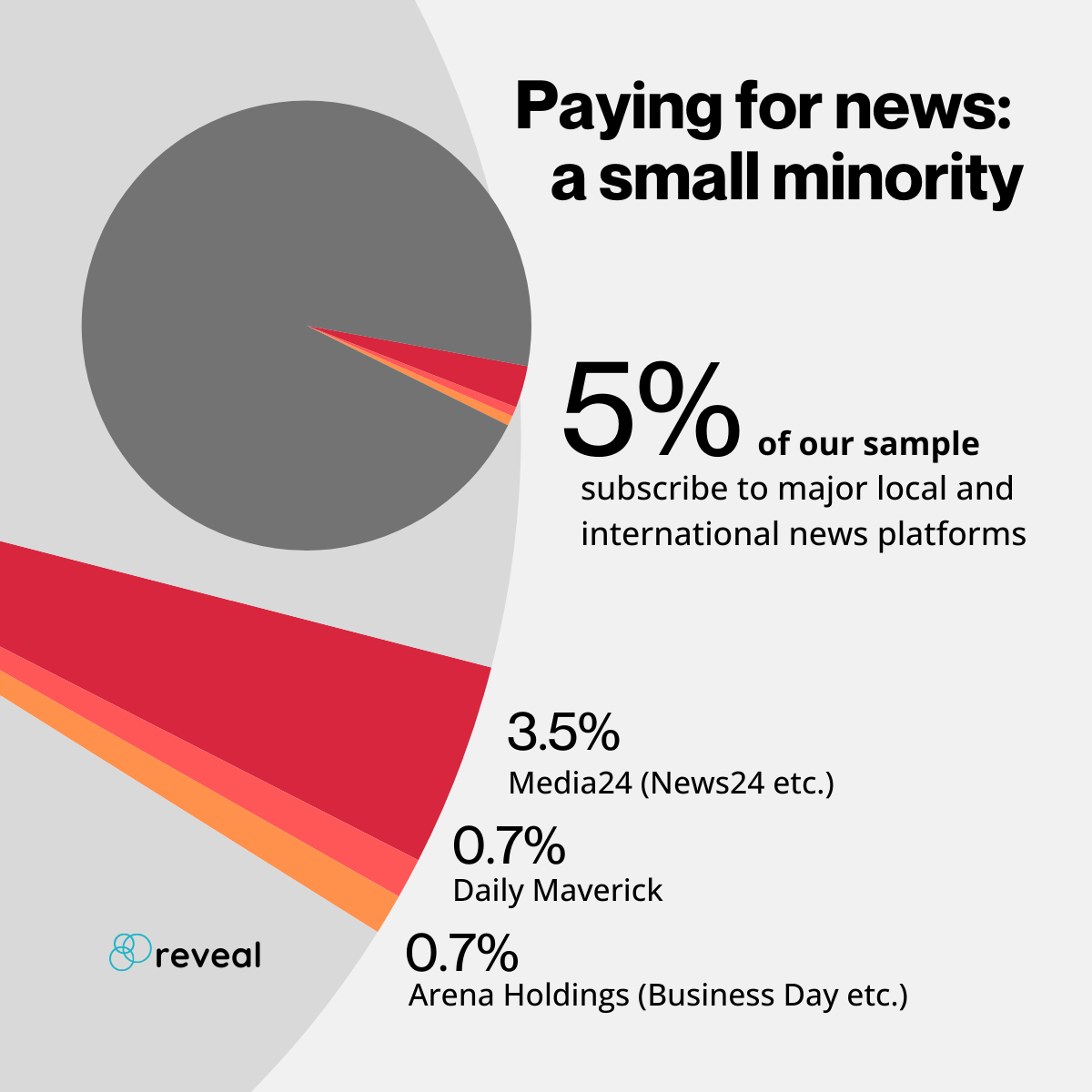

We analysed the spending data of 48,000 South Africans and isolated payments to local and international news platforms. The results are sobering. Only 5% of users in our sample paid for news. Of this slice, Media24 has the largest share by far, but this metric needs a disclaimer: We can’t be sure whether people are paying for important investigative journalism or to access other content from the publisher that also sits behind the paywall, like tabloid stories from You and Huisgenoot.

A News24 subscription costs R75 pm – our data confirms that this is the average payment made.

Daily Maverick relies on public support through their Maverick Insider programme. Even though the site is free, readers are encouraged to donate as much as they feel comfortable donating. There are some benefits to becoming an Insider, including PnP asap! and Uber discounts. Among the users in our sample, one out of every 150 people made a contribution to Daily Maverick, and the average amount was R175.

An almost identical number made payments to Arena Holdings, the group that publishes Business Day and Financial Mail, among others. A BusinessLIVE Premium subscription costs R129 pm, but our data shows that the average transaction value among subscribers was slightly higher, at R146 pm. (There are other subscription packages available, some involving a combination of digital and print.)

This is a sample of individual consumers. Of course, many companies subscribe to trusted news sources and make these sources available to their employees. Unfortunately, we can’t see how these subscriptions affect the numbers. But even so, in South Africa, it’s clear that the inclination to pay for news is low. Sadly, this means that the advertising-based model is likely to win out.

In amongst all the noise and clickbait, trying to determine which sources are credible will remain a challenge.

Reveal has access to alternative data that allows us to track actual consumer spending in real time. Our unique investment research helps industry leaders monitor the performance of their own companies and the performance of competitors. Get in touch to find out more.

One year of fuel

In 2023, Engen ran a competition where 30 people won fuel for a year. Actually, those 30 lucky drivers won R35,000 worth of fuel, which got us thinking: How much do South Africans spend on fuel in a calendar year?

To find the answer, we analysed spending at all the major fuel retailers, including Shell, Total Energies, BP, Astron, Engen and others, from March 2023 until March 2024, to see how much individuals spend in a year.

Here’s the good news. Despite the fact that the price of fuel seems to be on a never-ending upward trajectory, R35k is a very generous prize. Even when controlling for income, it’s the upper limit of an individual’s typical annual fuel spend.

The bad news is how badly the poor are affected by the rising price of fuel. Fuel spend increases with income, as expected, but at a relatively slow rate. Consequently, the proportion of monthly income allocated to fuel falls much faster as incomes increases.

In other words, someone earning R10–15k per month spends R13,300 per annum on fuel. Someone earning R40–60k per month spends close to R25,000 per year on fuel, but because their income is 4x higher, the proportion of that income the higher earner spends on fuel is 60% less. Since lower-earning users spend a much greater share of their monthly income on fuel, the fixed rand increase affects them so much more.

On a more frivolous note, have you ever wondered whether it’s more expedient to fill up to a round number rand value, say R400, or to fill your tank to the click?

We have, and it seems that many others have, too.

It turns out that 40% of the more than 800,000 fuel transactions in this analysis are multiples of R50. Remember, we’re just tracking card transactions – the huge numbers of cash transactions (almost always round numbers) are not included.

So, what’s the most popular amount? Controlling for income and age, two amounts stand out. For younger, lower-income drivers, R200 is the most popular fixed amount. For older, higher-income drivers, R500 is the winning number.

There you have it. Random information, maybe, but empirically true.

And here’s a final thought: If most people are spending R15,000 per year on fuel, and a large majority are spending R200 each time, it’s no wonder forecourts are important locations for a combo offering of a grocery retailer and a quick-service restaurant chain.

On the flip side, if consumers were somehow incentivised to increase their average transaction value – vehicles have the tank capacity and consumers will use the fuel – would we need as many service stations?

Food for thought while you eat your next garage pie.

If you want to find out more about how Reveal’s unique data and analysis can help your business, send us a mail. We can track any aspect of consumer spending in real time, from fuel stops to coffee shops.

The rise and rise of ChatGPT

According to OpenAI, the US-based group that owns ChatGPT, everyone’s favourite chat bot acquired 1 million users in 5 days, after launching in November 2022. By comparison, it took Instagram about 2.5 months to reach 1 million users. Netflix had to wait 3.5 years.

We asked ChatGPT how many users it has currently, but it played coy. Estimates peg the number at around 180.5 million. In January 2024, the website generated 1.6 billion visits.

It’s safe to say that ChatGPT is here in a big way, and it seems to be here to stay.

Most people use the free version of ChatGPT but there is also a paid-for version called ChatGPT Plus. The main differences: Plus accepts images and voice prompts as well as text; it’s more developer-friendly; and it’s more up-to-date since it can access the internet in real time. (Free ChatGPT cannot.) Subscribing to Plus also gives you access to the latest AI models and other OpenAI tools like the image generator DALL-E 3.

According to our data, these features are obviously sufficient because there has been a healthy uptick in subscriber numbers in South Africa since January 2023. So much so that more users paid for ChatGPT Plus in January 2024 than booked a night on Airbnb.

A subscription to ChatGPT Plus costs US$20 per month. Taking the fluctuating exchange rate into account from November 2023 to January 2024, that works out to an average spend of R387 per month.

Yup, ChatGPT Plus costs three times more than Netflix and 3.5 times more than Amazon Prime. Except for DSTV – where the average spend among the users we track is R563 per month – it’s the most expensive subscription service that we’ve analysed in this Nugget.

On top of that, our data shows that ChatGPT Plus subscribers are more likely to have multiple monthly subscriptions. Looking at entertainment subscriptions, we dug deeper and found that Plus subscribers are more like to also subscribe to services like YouTube Premium, Amazon Prime and Spotify. This could mean that they’re younger and potentially more tech savvy.

Oh yes, the orcas.

There you have it. If you want to find out more about how Reveal’s unique data and analysis can help your business, get in touch. We can track any aspect of consumer spending in real time, from grocery retail to whale-watching trips.

Padel's growing pains

A year ago, we published a Nugget about padel showing the extraordinary growth of the sport in South Africa. Given the audience, it may have been our most popular Nugget yet. Within many social circles – usually while waiting to fetch the kids outside the school gate – it’s nearly impossible to escape the topic.

Since then, padel has become even more mainstream and we thought it would be an apt time to get back on the court.

Quick reminder: Playtomic is the platform used for padel bookings, so those are the transactions we aggregated. Last February, we noted that the number of users paying on Playtomic for a padel game had increased by a whopping 14x since the year previously.

If padel was popular then, well… The number of users paying for games has since doubled again. (This shouldn’t come as a surprise to any full-time employed person hustling between appointments, amazed by the number of cars in the parking lot at 11am on a Tuesday.) While the number of people playing has increased, the frequency of games and cost per game has remained relatively stable: The average player is still paying for three games a month and R200 per event.

The owners of these overpriced squash courts are certainly smiling, but they’re not the only ones. Padel has been good for other industries, too.

Specifically, physios. Just as it has become hard to escape conversations about padel, it has become even harder to escape conversations about padel injuries. Again, maybe it’s the circles that I hang out in, or the hard truths of physical activity when you’re older than 40, but padel can be devastating to knees, ankles, calves and elbows.

We ran the numbers, comparing the likelihood of a padel player also paying for physio (or a similar expense) to the likelihood of a non-padel player also paying for that service. Again, the answer is double: a padel player is twice as likely to also pay for physio.

To preserve the dignity of all middle-aged men reliving their youth on the padel court, we chose not to segment this result by age…

Equipped with this empirical evidence, the most responsible thing for this middle-aged ‘athlete’ to do is buy a pair of those great-looking non-slip padel shoes. After all, it’s an investment in my health.

Do they qualify for a Vitality discount yet?

Reveal gives professionals an inside view of consumer spending, even when private companies are involved. Contact us to find out how our unique data can benefit investment analysts and business owners in almost any industry.

Padel – it's a hit

You’ve seen them – smallish astroturf courts enclosed by glass walls and fence panels. They’re padel courts, built for a sport that’s taking the world by storm.

Padel is the love child of tennis and squash, invented by a Mexican businessman in the 1960s. It’s played with a bat, and players are allowed to use the glass walls to rebound shots as in squash. The ball is similar to a tennis ball and scoring is the same as tennis. Padel has been popular in Latin America and Spain for decades, but recently its popularity has spread. It’s one of the fastest growing sports in the world and money is pouring into the top level of the game: Qatar Sports Investments, which owns football club Paris Saint-Germain, has invested heavily in the International Padel Federation (FIP), one of two rival associations fighting for dominance in the sport.

The infrastructure comes at a cost. Depending on the level of groundwork required, a single court can cost as much as R850,000 to build. Which in turn makes playing padel a relatively expensive pursuit. The vast majority of facilities are privately owned and run, and courts and bats are rented out by the hour.

To evaluate the growth of padel in South Africa, we looked at transactions made by 22seven users on Playtomic, an aggregator platform that seems to be the default padel booking service.

Last year was clearly a boom period for padel in South Africa, with the number of 22seven users paying to play increasing by 14x. As more padel facilities are built in the major cities, this upward trend seems set to continue.

The growth in the number of people paying padel has not affected the average spend per user. Among the cohort sampled, median spend per user per month had a minor flutter in February and March, then remained stable at around R400. Assuming the court costs are shared and players hire bats, R400 equates to roughly two visits to a padel facility each month.

Whether it's the fast-paced action, the social aspect or the beginner-friendly nature of the sport, padel’s addictive qualities are without question. Clubs and retailers had better take note.

Thanks for reading. If there’s a sector of consumer spending you’d like to learn more about, get in touch and let us know.

Time for an overhaul

When Uber launched in South Africa a decade ago, it felt like we’d stepped into the future. Remember the thrill of opening the app and conjuring a lift out of thin air? The experience was so good that Uber’s popularity skyrocketed and unleashed a slew of competitors like Bolt and others.

The concept was genius: Drivers could maximise the use of vehicles that would normally spend 75% of their lives standing still, and commuters could potentially convert some of the big, fixed expense of owing a vehicle into smaller, monthly expenses. At the time, people talked about selling their cars, or maybe a second car, and using Uber for daily trips.

But since then, the shine has faded. Whether or not Covid-19 was to blame, or simply because the industry grew too big too fast, e-hailing is a shadow of its former self.

As Daily Investor puts it: ‘Uber faces severe challenges in South Africa, including cars in a dilapidated state, bad drivers, frequent cancelled trips, driver strikes, and passengers being attacked and robbed.’

To evaluate the extent of the industry’s struggles, and to see how far it has fallen from the lofty heights of six years ago, we looked at how 22seven users are spending on Uber and other e-hailing apps.

The first metric we evaluated was spend on e-hailing as a proportion of total fuel spend. In the years before the Covid pandemic (2020), this was relatively stable. It fell sharply in 2021, however, and has never recovered.

We need to bear in mind that the price of fuel has increased rapidly over the period, evidenced by the sharp increase in average transaction value at fuel stations. Still, the average transaction value increase doesn’t match the fuel price increase, which suggests that users are moderating their driving: buying fewer litres at the pumps or topping up with less more often.

The chart below contrasts the average transaction value on fuel with the average e-hailing transaction value (right-hand side). On average, users spent less on an Uber trip in 2023 than they did in 2018…

Uber has introduced lower-cost alternatives, which may explain some of the decreases in spend, but what about the criticism of dilapidated and unroadworthy vehicles? With the cost of fuel having increased by 60% since 2020, not to mention the rising cost of vehicle financing thanks to higher interest rates, it’s no wonder that this core competency has taken a back seat…

The price of fuel is just one factor that has affected e-hailing. Maybe safety concerns during Covid caused users to move away, which led to lower spend, less maintenance and a weaker experience overall; or the service deteriorated first, which caused users to move away. Either way you look at it, fewer 22seven users are using e-hailing apps and those who do use them less often.

We’re in a dark tunnel, but maybe there’s a light at the end. Technology enabled the first phase of e-hailing and unlocked an undeniable benefit to society, there’s no reason why it can’t lead the industry into the next phase.

With a smartphone in nearly every rider and driver’s pocket, it is not hard to imagine a world where the incentives of both groups are matched more efficiently. For example, most of us would happily pay more for a ride if we could be certain ahead of time that the driver would obey the rules of the road and the vehicle would be roadworthy, air-conditioned and not smell of gym shoes.

Surely there’s an app for that?

22seven Insights gives professionals a unique view of consumer spending, even when private companies are involved. Get in touch if you want to know more about the transport sector or any other sector – retail, grocery, apparel, homeware, communication, health and more.

Nugget is our free newsletter about data-driven consumer trends. Make sure you don’t miss one – sign up here.

22seven is a safe and secure digital service that allows you to see all your money in one place and get a personalised budget, automatically. Our goal is to help South Africans take control of their finances.

Who rules fuel?

It’s Tuesday evening. You’re busy making dinner, looking at your phone and you see on Twitter that the fuel price is increasing tomorrow. Again. You sigh, tie your gown (you’re not planning to get out of the car) and head to the nearest fuel station to fill your tank, which is already three-quarters full, to save 50c per litre.

You’re not alone… Our data shows that 22seven users flock to fuel stations immediately preceding a fuel price increase. Logically, they’re also not too concerned about filling up in the days before a price decrease.

.png)

We last analysed the fuel sector in August 2022, soon after a steady succession of price increases. In June 2023, the inland price of a litre of 95 unleaded was R22.63 – less than the July 2022 high of R26.74 but still vastly more than the 2021 low of R14.86.

Yet people still somehow manage to make space in the budget to fuel their cars. To get a picture of the market, we looked at the sum of all 22seven user spending at South Africa’s most popular service stations. Engen emerged as a clear winner, with 44% of market share.

Why does Engen seem to attract the lion’s share of spend? The answer might not have anything to do with fuel… When it comes to average transaction value at service stations, Engen is roughly on a par with most other franchises but it’s far ahead in average monthly spend. We surmise that this is due to Engen’s relationship with Woolworths – their Foodstop stores are popular convenience shopping destinations across the country.

The Woolies effect is also at play when we look at the number of visits customers make to service stations each month. While most other service stations attract an average of two transactions per user per month, Engen attracts more than three – evidence again of a broader value offering that goes beyond fuel.

No fuel increases have been announced for the immediate future so you don’t have to rush off to the pumps… But next time you do, remember that spending at service stations is just one example of 22seven insights’ ability to analyse almost any aspect of the consumer budget – in real time.

What’s my @#$& password!?

For most of us, living in a digital word means endless usernames and passwords. Almost everything requires logging in: e-mail, streaming services, social media accounts, news services, your bank and medical aid – even some kitchen appliances!

It’s true that many of these services are moving towards a future where you don’t need to input a password – where biometric data or a one-time pin (OTP) will be used to verify your identity – but that future hasn’t arrived yet. And in the meantime, the challenge of remembering a hundred passwords is real.

That’s where a password manager comes in. It’s a cloud-based app that acts like a vault for all your passwords. You essentially only need to remember one login and password: the one to get you into the vault. Most of these apps sync with the online services you’re trying to access, logging you in automatically.

The danger here is that all your passwords will be compromised if there’s a data breach at the password manager (as happened at LastPass in 2022), but many consumers are prepared to take that risk for the peace of mind and ease of use that the password manager provides.

We wanted to see if the use of password manager apps is increasing in South Africa, and what 22seven users are spending on the service.

Using a password manager remains niche, but it’s growing: There has been 56% growth in users paying monthly for a password manager since this time last year. Keep in mind that the adoption rate might be even higher, since many users will be using a pared-down, free version of the software.

Which apps are popular? Looking at the average number of users transacting per month in 2022, it seems that three services are attracting the lion’s share of users: 1Password is the clear favourite, with LastPass and Dashlane as runners up.

When we aggregate the average monthly spend, LastPass and 1Password emerge as leaders. And the amounts are not insubstantial, demonstrating a willingness for consumers to pay for a service that they feel adds practical value.

This research is an example of how 22seven Insights can provide companies with transactional data for almost any consumer service. Want to find out what’s happening in your industry? Contact us using the button below.

What do retail investors own?

‘If you hope to distinguish yourself in terms of [investment] performance, you have to depart from the pack. But, having departed, the difference will only be positive if your choice of strategies and tactics is correct.’ – Howard Marks

The renowned US investor might be onto something. For investors to achieve superior results, they have to have a portfolio that looks different to the market – and they have to be correct in their choices.

This is much easier said than done, of course, especially for so-called retail investors who are often at a disadvantage compared to professional investors. For starters, retail investors usually have jobs in other industries and don’t have the time to follow all the company announcements or attend events with company management for a better understanding of future prospects. They’re also influenced by social proof and media hype, leading to a focus on short-term gains rather than long-term goals. As a consequence, many retail investors routinely make stock selection mistakes.

But there are benefits to being a retail investor. In a highly concentrated market like the JSE, a handful of companies make up the majority of the total market cap. Most of the roughly 240 companies are too small and not liquid enough for large investment managers to buy enough shares to fill their portfolios, which makes it difficult for those managers to reflect the full breadth of choice of the companies listed on the exchange.

The average retail investor, on the other hand, can buy shares in just about any listed company. Professional investors who follow Marks’s principle of being right and different would love to see what choices the retail investors are making, but this data is notoriously hard to come by as you can’t just peek into an individual’s private portfolio.

At 22seven Insights, we’re in the privileged position of being able to aggregate the investing behaviour of groups of retail investors by scanning the holdings of ~7,000 22seven users across major share-trading platforms. We did this at the end of January 2023 to see what trends we could see…

First, we looked at the large companies – the ones with the biggest market caps included in the JSE Top 40 Index. Among 22seven users, the most commonly held shares at the end of January 2023 were Sasol, MTN and Naspers.

On its own, this information isn’t too surprising and its likely that professional managers would also have these companies in the top 10 of their flagship funds. Whats more interesting is what’s not in the top three holdings: the likes of Richemont, Anglo American, FirstRand and British American Tobacco, all of which are larger companies than Sasol or MTN.

But where it gets really interesting is when we look at the smaller companies…

The graphic above shows which smaller companies were very common holdings in the sample: an interesting mix of energy, fintech and retail. Compared to giants like MTN et al, these companies are tiny and it’s highly unlikely that any major investment firm would have them in their top 10 list.

Based on our short analysis, it seems that the portfolios of retail investors do indeed look different, with a different mix of companies, but will these investors be right in their choices? We look forward to following up on their performance in due course.

This research is an example of 22seven Insights’ ability to analyse niche sectors of consumer spending. Want to find out what’s happening in your industry? Get in touch using the button below.

Ready to unlock new insights?

One of the team will get in touch soon!